Ask any friend or family member that owns a home and they will share that it takes a bit of management to keep all the expenses under control. Let’s explore the concept of PITI and why it is vital to have a clear picture of how much your home is costing you each month.

Just What Is PITI, Anyway?

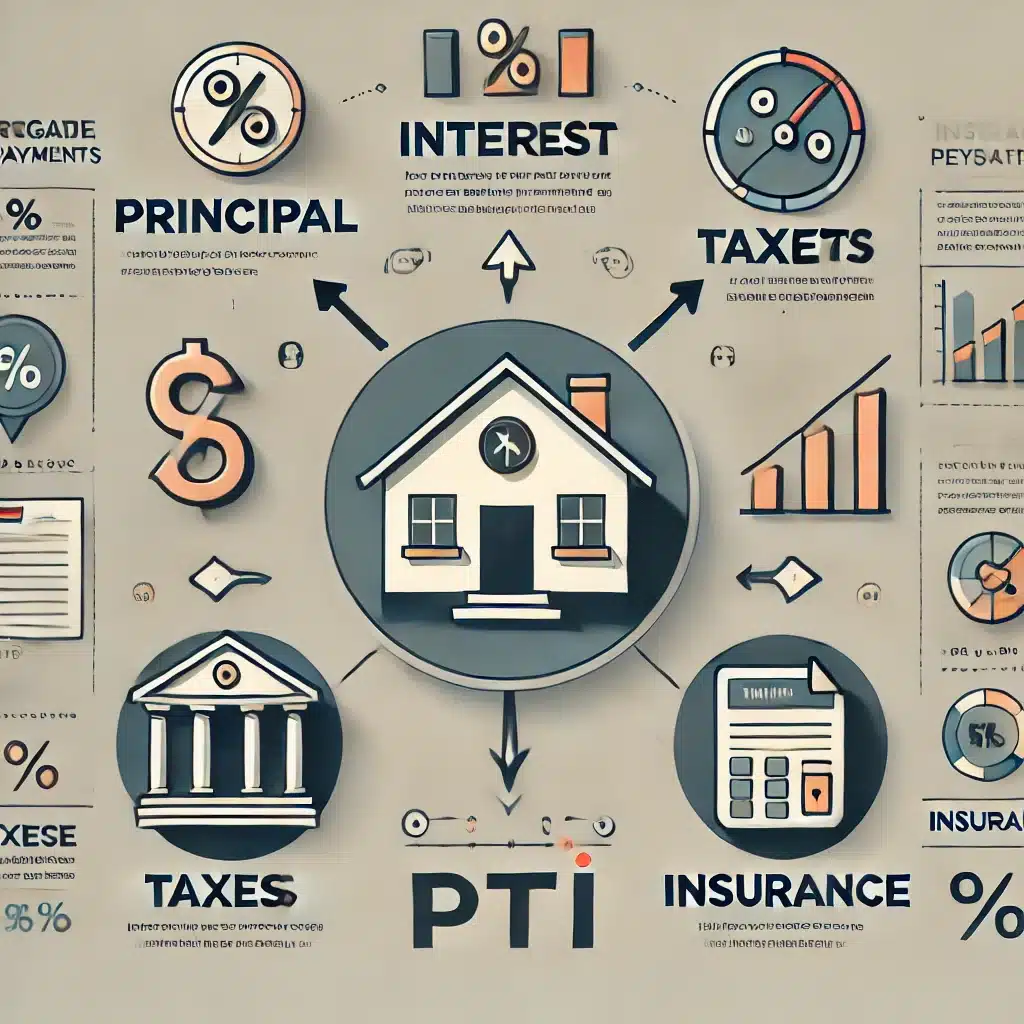

PITI is an acronym that stands for “principal, interest, taxes and insurance,” which are the four main components that make up your housing costs.

Principal – this is the amount that you are paying against the total amount that you borrowed when you purchased the home. For example, if you used a mortgage to cover $200,000 of the home’s purchase price, the remaining balance of that $200,000 is the principal. A part of your monthly mortgage payment goes to paying down the principal.

Interest – this is the extra cost that the lender charges for the service of lending you the principal amount. For most mortgages, you will see this expressed as an “interest rate” which is a small percent charged on the loan. A portion of your monthly mortgage payment goes to paying down the interest owed.

Taxes – tax costs are not included in your monthly mortgage payment, but will be added by your lender as part of your yearly expenses when calculating your debt-to-income ratio (see below). Property taxes and other assessments will need to be paid each year.

Insurance – this is the cost of insuring your mortgage and your home. Like taxes, your mortgage lender will typically include some insurance costs in your DTI ratio calculation.

How Lenders Use PITI

Many mortgage lenders use some form of PITI calculation when determining your debt-to-income ratio. This ratio helps the lender understand your ability to manage your monthly mortgage payments without being at risk of missing one. The lower the ratio, the more likely you can afford all your monthly expenses.

Don’t Forget Your Other Monthly Expenses

Finally, don’t forget that along with PITI you will have a variety of other monthly expenses that need to be budgeted for. Leave some space for utilities, repairs and other renovations that need to be made throughout the year. If you are considering selling your home, be sure to contact us at (850) 407-2024 or email us at bryce@pelicanbuyshomes.com so we can provide you with a Fair Cash Offer on your Nationwide house.

Want To Get A Cash Offer On Your Nationwide house?

Please fill out the quick form below, and we will be in touch with you shortly!

"*" indicates required fields