In the market for a new home next year? With the new year just around the corner, that leaves you with precious little time to get your finances in order. Let’s explore a few tips that will help you get a jump on improving your credit score before the end of the year.

Grab A Fresh Copy

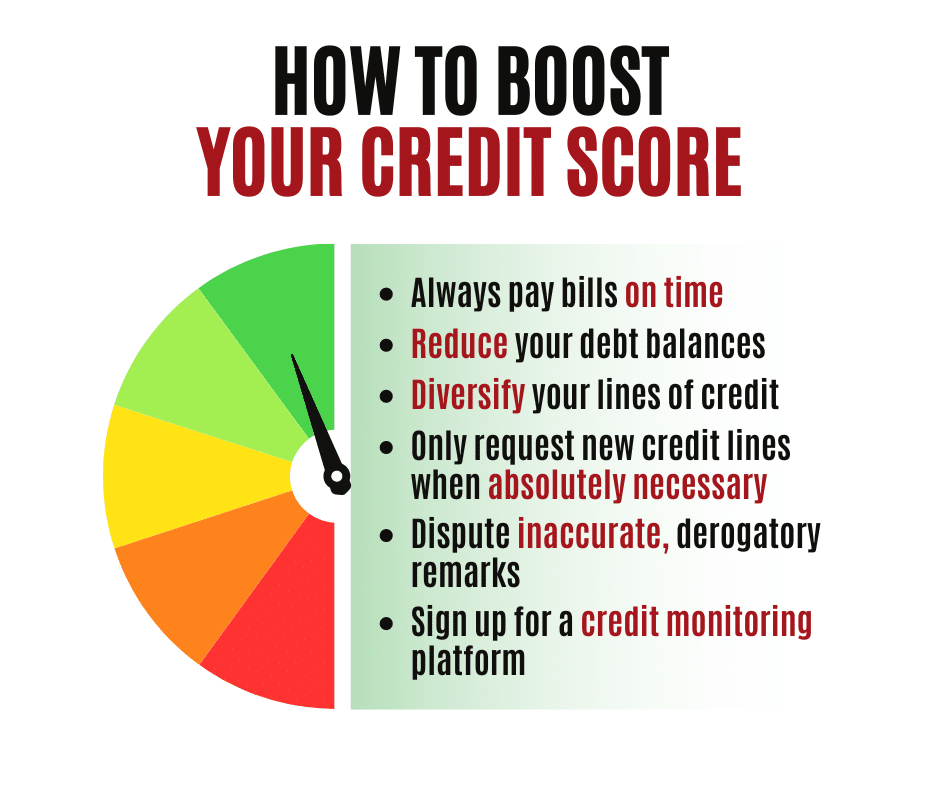

The first step is to order a fresh copy of your credit report from one of the major agencies. The Fair Credit Reporting Act allows you to access a free copy of your credit report once every 12 months. So, if you have not ordered a copy recently, it is time to do so. You can access this free service through AnnualCreditReport.com, which is a website recommended by the Federal Trade Commission. Note that it’s not recommended to use a search engine to search for “free credit report” or similar search terms. There are many impostor websites looking to obtain your personal financial information for nefarious purposes. Instead, stick with the government-recommended website listed above.[/et_pb_text] Now that you have a copy of your credit report, it’s time to go through it, line-by-line. You should recognize every current and outstanding account in the report. Any balances owing should be in order and reflect how much you owe. It’s critical that you flag any mistakes or old debts that you have already paid in full. If you come across anything that shouldn’t be on your credit report, call the reporting agency to let them know. If necessary, they will assist you with challenging the issue. The final tip in today’s guide is to prioritize your outstanding debts so that you can pay them off more efficiently. The essential debt payments are your mandatory minimums, which you need to pay to avoid being sent to a collection agency. From there, try to pay off your debts with the highest interest rates first. Getting these paid off faster means that over time, you’re spending less on interest payments. Moreover, you can use that extra cash to pay your debts down further. If you are considering selling your home, be sure to contact us at (850) 407-2024 or email us at bryce@pelicanbuyshomes.com so we can provide you with a Fair Cash Offer on your Nationwide house. Clean Up Anything Outstanding

Pay Down Those High-Interest Debts

Want To Get A Cash Offer On Your Nationwide house?

"*" indicates required fields